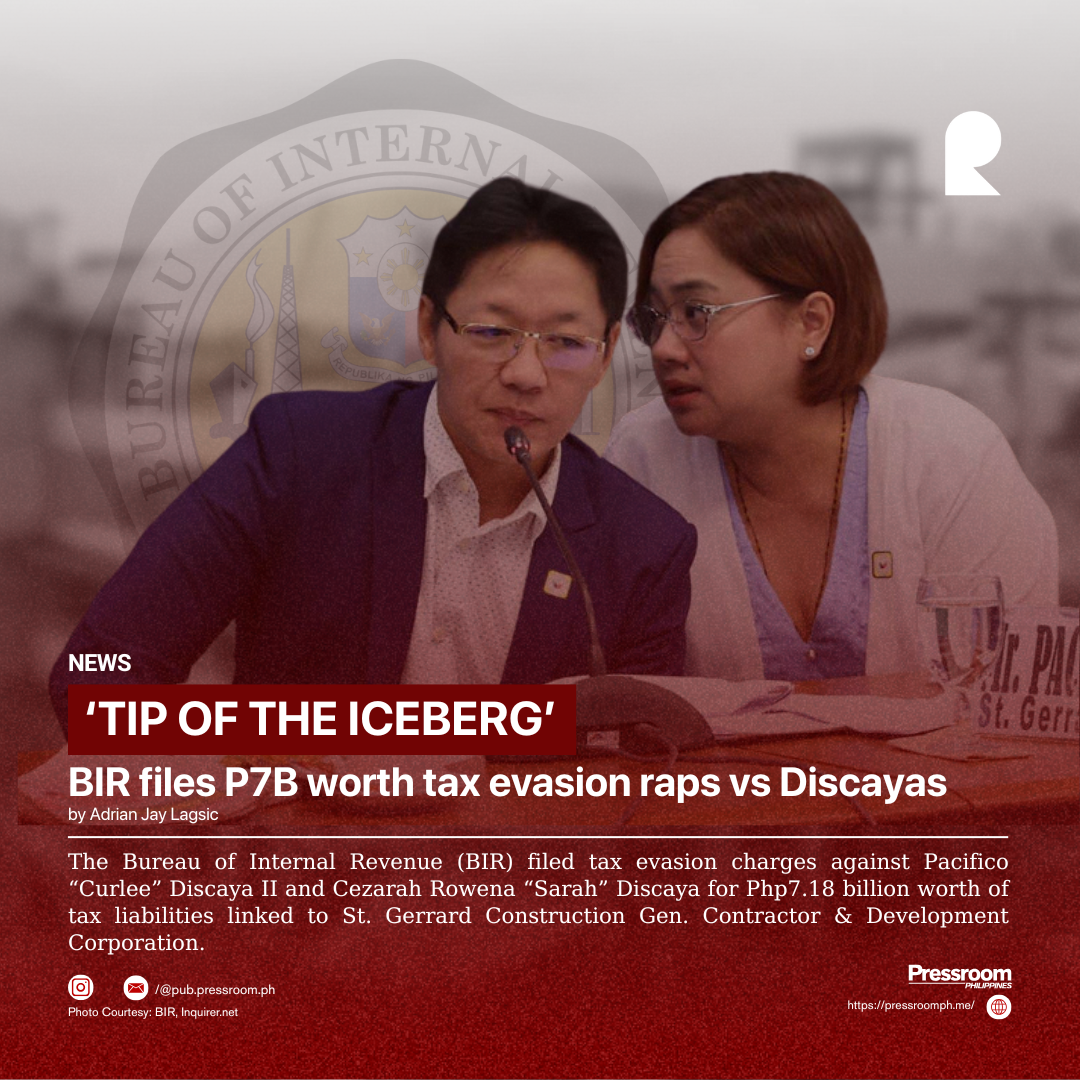

The Bureau of Internal Revenue (BIR) filed tax evasion charges against Pacifico “Curlee” Discaya II and Cezarah Rowena “Sarah” Discaya for Php7.18 billion worth of tax liabilities linked to St. Gerrard Construction Gen. Contractor & Development Corporation.

BIR Commissioner Romeao Lumagui Jr. described the case as “the tip of the iceberg,” emphasizing more issues to be uncovered.

The charges include unpaid individual income taxes for 2018-2021, unpaid excise taxes on nine luxury vehicles, and unpaid documentary stamp taxes related to divestments from four Discaya-owned construction firms.

Ongoing audits of Discaya-owned construction firms are expected to reveal more significant tax deficiencies.

The Discayas claimed to have divested from several companies but did not file the necessary returns or pay the corresponding taxes.

Additionally, the BIR found no official documentation or proof of such divestments or taxes paid.

Excise tax returns for nine luxury vehicles registered under the couple's names were not filed, nor were the excise taxes paid.

Lumagui affirmed the ongoing audits and the possibility of additional tax evasion cases based on new findings.

The BIR's focus extends to other contractors and officials involved in irregular flood control projects and is committed to pursuing all suspected tax violations to ensure compliance and justice in tax matters.